Recover Deleted Invoice in QuickBooks With Easy Steps

Often, QuickBooks customers have queries such as, “Can I recover my deleted invoices in QuickBooks?” The answer usually is No. QuickBooks does not have a feature that saves all of your changes or invoices to recover from.

But this isn’t true. Yes, there is No such a feature, but QuickBooks does have an audit trail, and the deleted invoices are recoverable. You can turn off the audit in QuickBooks depending on your requirements.

This guide will provide step-by-step instructions for recovering deleted invoices in QuickBooks, whether on the desktop or online version.

Learn How to Retrieve Deleted Invoices in QuickBooks

Sometimes, you may get confused because there is no specific restore feature to recover deleted invoices in QuickBooks, but that doesn’t mean you can’t recover them. Below, we will discuss two ways to recover your deleted invoices in QuickBooks desktop and Online.

These two ways are: through the audit log (QuickBooks Online) and by running a report (QuickBooks desktop).

QuickBooks Online: Audit Log

Here’s how to use the audit log in QuickBooks Online to recover deleted transactions or invoices:

- Go to Settings from the left menu bar.

- From the options, select Audit Log.

- Select the Filter drop-down menu.

- Choose the appropriate user, date, and event of the invoice.

- Click Apply.

- Now, look for the deleted invoices. You can search for deleted invoices by pressing the Ctrl+F keys. A search bar will appear at the bottom, type Deleted and it will be highlighted wherever deleted is used.

- Click View under the History column of a deleted invoice.

- The Event column should contain all the information you require; you can use this information to enter the invoice details again. It will appear as though it was never removed.

As the Audit Log approach only works with stored transactions, it could be wiser to invalidate a transaction rather than erase it entirely in the long run.

QuickBooks Desktop: Reports

Access a deleted invoice using the Reports by following the steps below:

- Navigate to Reports, then select Accountant.

- Run the Voided/Deleted Transactions Report.

- Now, you will see the details of the invoice under question.

If you need more information on this report, you are allowed to add columns. You cannot fully restore the deleted invoice, but print it or save the transaction report to keep the information so you can re-enter a new invoice.

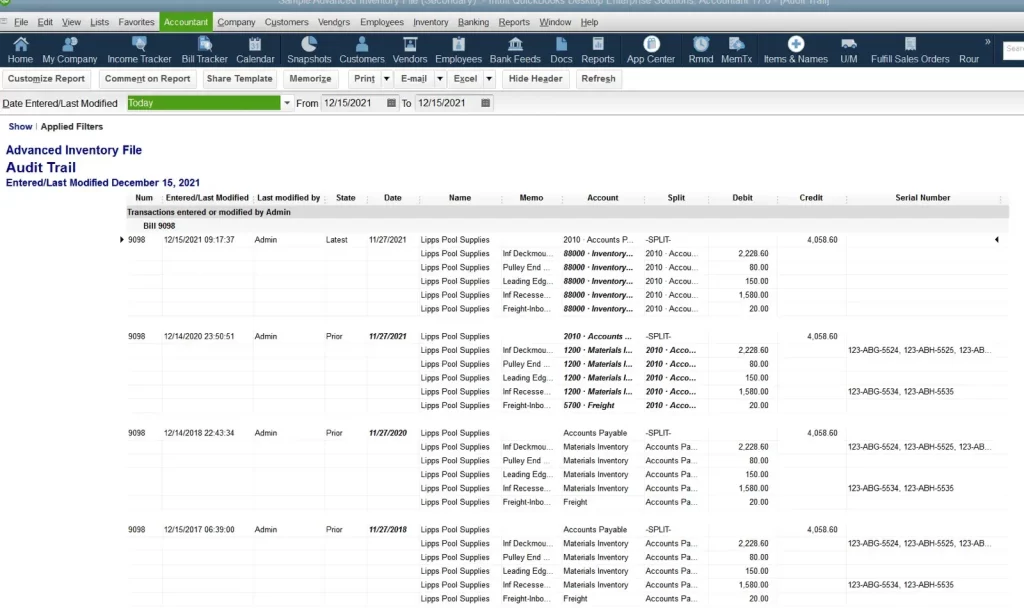

Audit Trail in QuickBooks: An Overview

The QuickBooks Audit Trail logs each accounting transaction. Additionally, it displays any modifications you made, the transaction’s deletion, the person who made the changes, and the time they were made.

The audit trail saves all information associated with a transaction from the time it is initially entered into QuickBooks. The transaction type, date, account, vendor/customer name, transaction amount, quantity, and price are among the details that are tracked when an entry is modified.

The audit trail also reveals the user ID under which the entry, deletion, or modification was made. To generate the report, just click a button. This tool is a report that is integrated into the QuickBooks Report Center.

Access Audit Trail in QuickBooks

Let’s look at how you can access the Audit Trail in QuickBooks to see if it’s enabled or if you can even turn it off:

You can easily filter the Audit Trail report by number or date to fin the deleted invoices or other transactions you are looking to recreate. The report gives you two date ranges which are – Transaction date or the Modified date.

If you know when the transaction was originated or modified, this gives you some leeway in determining how to locate it most effectively.

View transaction changes in the audit trail history

The Audit history saves all the changes related to transactions saved in QuickBooks. The modifications are visible, along with who made them, when they were made, and what they are. Here’s how you can see the changes in a transaction:

- Open the transaction for which you want to see the changes.

- Click on More.

- Now, choose Audit history, and it will open the Audit trail.

- Click on Show all for an expanded view for a side-by-side comparison.

- Finally, click Compare to see the changes.

Summary

So, you must have an answer to your queries, such as “Can I recover a deleted invoice in QuickBooks, and how?” Using different methods, we have covered the steps to retrieve your deleted transactions or invoices in both QuickBooks Online and Desktop. An audit trail is the primary way you can keep track of all the changes to your log file and how to recover them.

If you need further assistance recovering your deleted invoices, we recommend you contact professionals. Dial +1-866-409-5111 and talk to a QuickBooks expert now!

Frequently Asked Questions

The steps vary depending on the QuickBooks version you use to check the audit history. If you use QuickBooks Desktop, Reports> Audit Trail under Company & Financial. If you are a QuickBooks Online user, go to Settings and select Audit Log.

An audit trail is a thorough and sequential recording of your accounting transactions, project information, transactions, user activity, and other recorded and traceable financial data.

No, it is not possible to disable QuickBooks’ audit trail. QuickBooks keeps an audit trail to monitor modifications and guarantee the accuracy of financial data for audit and security purposes.

An audit trail is a comprehensive, chronological record of events and user actions within a system, primarily used for tracking and verifying activities related to security, compliance, and accountability. A log is a broader term that refers to any record of events, actions, or system status, including audit trails

An audit trail is crucial for ensuring the integrity and reliability of data and processes, particularly in areas like finance and security. It provides a detailed record of actions taken, including who made them, when, and what they did.