Correct Errors in the QuickBooks Balance Sheet Out of Balance

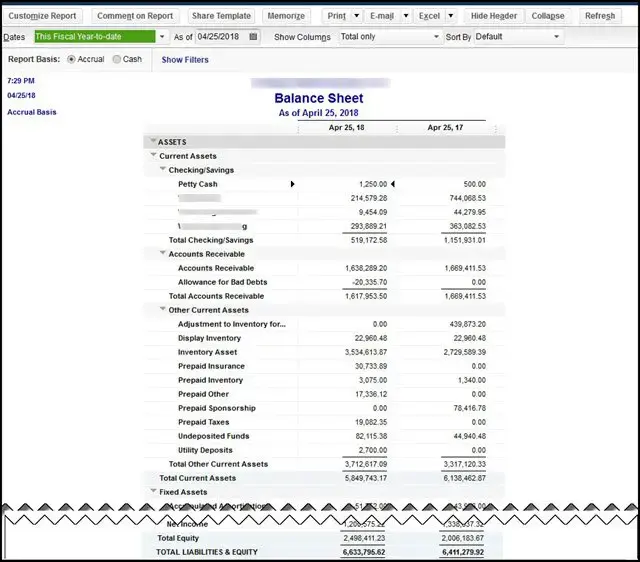

In QuickBooks, a balance sheet is a financial report that gives you a snapshot of your company’s finances in one place. An imbalanced balance sheet shows the liabilities and current-year assets with what it owes, or its liabilities and owner equity. The balance sheet follows the fundamental accounting equation: Assets = Liabilities + Equity.

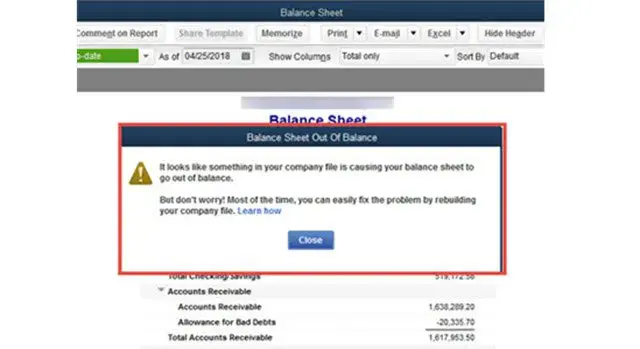

If your QuickBooks Balance Sheet is out of Balance or you have tried running the Balance Sheet report, it may show the balance sheet in balance despite an error. Either this is because it does not include the prior year’s retained earnings and just shows liabilities and current-year assets. At the same time, when you run another company in the same version, the balance sheet shows up with no issues. Read this detailed article for suitable steps to fix the error when balancing the Balance Sheet.

Why is the balance sheet report out of balance in QuickBooks?

There are multiple reasons why your QuickBooks balance sheet is out of balance in QuickBooks Desktop. Explore these reasons one by one in the below section:

- The user may have mistakenly entered an offsetting journal entry (GJE) for an open credit memo.

- When both the linked transactions in the balance sheet are incorrect, the balance sheet may become unbalanced, or there may be a wrong entry.

- One of your customers may have returned inventory whose data has been recorded. Or the invoiced discounted product may have also been returned.

- When you have entered payment for your inventory against an invoice, the QB user punches an entry in the Credit tab or Discounted tab of the sheet.

Note: If you have entered the wrong tax tracking type or want to make changes for employees who would not get further payroll, adjust QuickBooks payroll liabilities.

Steps to fix issues when the QuickBooks balance sheet out of balance

Your total assets should match your total liabilities on your Balance Sheet to accurately track a company’s profitability over a period. If they don’t match, proceed with the below steps and learn how to balance the Balance Sheet in QuickBooks Desktop.

| Tip: Balance sheet reports can be tricky. It’s a good idea to ask your bookkeeper or accountant for help before you continue. If you don’t have one, we can help you find an accountant. Important: Since you might have to edit transactions to fix this problem, you should make a backup before you continue. |

Step 1: Run the report on an accrual basis

If you haven’t already, run the report on an accrual basis to understand your finances much better:

- In QuickBooks Desktop, go to the Reports menu.

- Choose Company & Financial and then click on Balance Sheet Summary.

- Hit on Customize Report.

- Go to the Display tab and choose Accrual under Report Basis.

- Finally, click OK.

If you see the balance sheet is out of balance on an accrual basis, you must consider running the rebuild utility. If the sheet is out of balance in cash only, it’s still out of balance after a rebuild. Proceed to the next step.

Important: Note whether your balance sheet is out of balance on an accrual-only basis or both cash and accrual basis. This will be required in further steps.

Step 2: Find the date when your balance sheet went out of balance

To locate the transaction or transactions causing the problem, find the exact date this report went out of balance.

- Navigate to the Reports menu and choose Company & Financials.

- Hit on Balance Sheet Summary.

- Select Customize Report.

- Go to the Display tab and select All from the Dates dropdown.

- Scroll down to the Report Basis section. Select Accrual any if your balance sheet is out of balance in accrual. Otherwise, hit on Cash.

- Select Year in the Display columns by clicking the dropdown in the Columns section.

- Tap on OK.

- Now, compare your Total Assets to Total Liabilities & Equity. Look for the details when your balance sheet goes out of balance.

Once you find the year, follow the same steps to narrow down the exact date.

- Repeat the above steps 1 to 6. But instead of selecting Columns in the Display columns by dropdown, select Month.

- Follow the steps from 1 to 6 again. This time, select Week.

- Repeat the steps again once you find the week. This time, select Day.

- Now that you have the date your report went out of balance continue moving to step 3.

Step 3: Find the transactions that are making your balance sheet out of balance

Noted the exact date? Run a Custom Transaction Detail report for the same date by following the below steps:

- In QuickBooks Desktop, go to the Reports menu and choose Transaction Detail.

- Look for the Report Date Range section in the redirected Modify Report window. Now, enter the date the report went out of balance in the From and to fields.

- Scroll down to the Report Basis section. If your balance sheet is still out of balance in accrual only, select Accrual. Otherwise, select Cash.

- Uncheck the option for Account, Split, Clr, and Class in the Columns section. This makes it easier to read and then select the Paid Amount column.

- Hit OK.

- Make sure the ending balance in the Paid Amount column is equal to the amount that is out of balance. Thoroughly review the report to find the transactions or transactions that add up to this amount.

Step 4: Re-date the transactions

- Change the dates once you find the transaction or transactions causing the problem. Also, note their current dates and then edit the date on each transaction to a day 20 years in the future.

- Now, save each of the transactions you make changes to.

- Refresh the report, and if you find the correct transactions, your Paid Amount column will now be zero.

- Locate the only transactions dated into the future and change their date back to the original.

- Note: When you re-date the transactions, it will re-link and repair them.

Step 5: Delete and reenter the transactions

If changing dates and reentering the transaction(s) doesn’t fix the issues, consider deleting and reentering them.

Summary

You must ensure the Balance sheet in QuickBooks is balanced and there are no discrepancies for maintaining accurate financial records and making informed business decisions. However, if your QuickBooks balance sheet is out of balance, it shows errors with the recorded financial transactions, mismatches with transactions, or accidental deleting. The information in the article is all you need to ensure the recorded data or your balanced sheet is accurate.

If you have further questions, contact Qbookshub professionals who are available 24/7 to offer assistance. Dial Call Us : +1(866)409-5111 to connect with QuickBooks ProAdvisors now!

Frequently Asked Questions

If your total assets don’t match your total liabilities on your balance sheet, it means your balance sheet is out of balance in QuickBooks Desktop. This may happen due to incorrect or mis linked transactions, multi-currency issues, duplicate entries, or possible data damage to your company file.

If your balance doesn’t match, it means their must be an error in your accounting data. To fix this, you need to thoroughly review all the entries, including the trial balance and income statement, to identify the root cause and make the necessary adjustments. Additionally, consider deleting the unmatched transactions and re-enter to make the transactions matches correctly.

Your QuickBooks might be off due one of the following reasons: your account was not set up a balance or we can say with the right balance. All the transactions that you have reconciled or cleared were voided, deleted, or modified.

To fix reconciliation discrepancies in QuickBooks Desktop, review the bank statement and QuickBooks records, match them both, identify and correct errors, and finally reconcile the transactions correctly. You can undo a previous reconciliation, run a discrepancy report, or make adjustments in QuickBooks if necessary.

The QuickBooks balance can be lower than the bank balance due to several factors, including outstanding or pending transactions, new transactions for a connected account that haven’t been added to QuickBooks, duplicate transactions, or edited/deleted transactions. Additionally, if there are expenses that have cleared the bank but haven’t been entered into QuickBooks, the balances will differ.