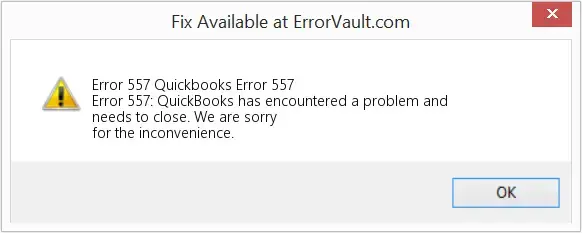

Resolve QuickBooks Error 557 When Installing Payroll Update

QuickBooks error 557 appears on your screen when attempting to download payroll tax table updates. This error typically indicates an issue with QuickBooks Desktop, problems with the update process, or conflicts within the system environment.

Several factors can trigger this error, such as using an outdated version of QuickBooks Desktop or failing to register the software for updates. However, these are not the only causes, as the issue can stem from various other sources. In this detailed blog, we will explore all possible reasons behind error code 557 and provide effective solutions to resolve it.

Key takeaways:

| 1. Active payroll subscription: An active payroll subscription is required to receive payroll tax table updates. 2. Correct software installation: Make sure your system files are not damaged as this usually disrupts the functioning of the software including updates. |

What Causes QuickBooks Payroll Error 557?

Let’s explore the possible factors that are responsible for error code 557 when updating payroll services to the latest release:

- You might not have registered your QuickBooks Desktop to receive the entire update

- Not using an up-to-date QuickBooks Desktop version

- Inactive payroll subscription

- Possible corruption or damage to the EntitlementDatastore.ecml file

- Incorrect employee EIN service key number

- Microsoft Defender on your system might have blocked QuickBooks processes

- Incorrect installation or internal issues with QuickBooks Desktop itself

How to Troubleshoot Payroll Error 557 in QuickBooks Desktop?

To resolve QuickBooks error 557 you must address the underlying cause. Since there are no specific causes, you must follow the troubleshooting methods accordingly.

Let’s go over this detailed section and perform these fixes to ensure that you can get payroll tax table updates:

1. Register and update QuickBooks Desktop

You can only receive the latest QuickBooks updates if the program is registered, and it is important to have the latest security and software improvements. Let’s see how to register your QuickBooks Desktop and get the most recent release:

- Launch the Product Information window by pressing the F2 key.

- Check if software says Activated beside the license number.

Note: If it doesn’t say Activated, you must register your QuickBooks program.

Let’s see how to register your QuickBooks Desktop:

- Launch QB Desktop.

- Select Help from the top menu bar

- Now, hit on Activate QuickBooks Desktop.

- Adhere to the on-screen instructions to verify your info.

After you register QuickBooks Desktop, update it to the latest release.

- Select Help.

- Click on Update QuickBooks Desktop from the drop-down.

- Hit on Update Now.

- Mark the checkbox for Reset Update to clear the updates.

- Finally, hit Get Updates.

- Close and reopen QuickBooks again to install your update.

2. Reactivate payroll subscription

Let’s look at how to reactivate your QuickBooks Payroll subscription:

Note: Either you can get the entire QuickBooks updates with payroll services. Or follow the methods mentioned below. Before getting started, make sure to update your QuickBooks.

Through your company file

The best or easiest way to reactivate your payroll subscription is directly in your QuickBooks Desktop company file.

- Select Employees in your QuickBooks Desktop company file.

- Click on My Payroll Service.

- Hit on Account/Billing Info.

- Sign in to your Intuit Account using the credentials.

- This will open the QuickBooks Account page.

- Choose Resubscribe under the Status bar.

- Follow the instructions on your screen to reactivate your payroll service.

Through your Intuit account

Another way to reactivate your payroll services is to use the web.

- Sing in to your Intuit account like as normally would login.

- Click on Resubscribe under Status.

- Follow the on-screen steps to complete the reactivation of your payroll services.

Note: The entire reactivation of your subscription may take up to 24 hours. After the reactivation is finished, your subscription will appear as Active.

3. Get the payroll tax table update

Consider downloading the tax table update manually by following these steps:

- Navigate to Employees in QuickBooks Desktop.

- Hit on Get Payroll Updates.

- To know which tax table version you use:

- Check the version number next to You are using tax table version:.

- To see if you use the correct or up-to-date version, see the latest payroll news and updates.

- To check more details on the tax table version you use, select Payroll Update Info.

- Now, to get the payroll tax table:

- Tap on Download Entire Update.

- Click Update. Once the download finishes, an informational window will appear on your screen.

4. Rename the EntitlementDatastore.ecml file

You may fail to update payroll services when license synchronization occurs or when the EntitlementDatastore.ecml file is damaged. Consider renaming the file to fix these sync and data damage issues:

Note: The folder for the Entitlement Client is hidden. Before following these instructions, you might need to use Windows to search for files or display hidden files and directories.

- Go to the Windows Taskbar and choose the File Explorer icon.

- Navigate to the View tab and click on Hidden Items.

Now, rename the EntitlementDatastore.ecml file:

- Press the Windows+R on your keyboard to open the Run command.

- Copy the file path C:\ProgramData\Intuit\Entitlement Client\v8 and paste it.

- Press the Enter key.

- Right-click on your EntitlementDataStore.ecml file. Then, select Rename.

- Add .OLD at the end of the EntitlementDataStore.ecml.OLD name.

5. Correct the EIN service key

The EIN service key may be incorrect because you entered it incorrectly or because the software misinterprets the data fields. Therefore, you can correct the service key number and try again to get your payroll tax table updated:

- Go to the Employees menu> My Payroll Service > Manage Payroll Service.

- This will open the QuickBooks Service Key window.

- Click on Add if no payroll service is listed.

- Hit on Edit, if a payroll service is listed.

- Again click Edit, and take note of the service key.

- Remove the payroll service key in QuickBooks.

- Now, click Next.

- Select OK on the Payroll Update message.

- Make sure the Service Status shows ACTIVE and then select OK.

6. Add Defender exclusion

If Windows Defender blocks your QuickBooks files, you must create an exclusion for specific QuickBooks files. To address this, the QuickBooks Tool Hub has introduced users to a new feature that helps them quickly create exceptions.

When you add QuickBooks files to the list, Microsoft Defender can no longer scan them during installation, allowing the update to proceed at its expected speed.

Note: When adding exclusions, signing into Windows as an admin user is necessary. Otherwise, the Add Defender Exclusion will be grayed out, and you will need to ask permission from the admin user or if they can add the exclusion for you.

- Hit Cancel to stop the update.

- Exit QB Desktop.

- Launch QuickBooks Tool Hub.

– Please follow the steps in this article to download and install QuickBooks Tool Hub if you don’t already have it.

- Hit on Installation issues.

- Choose Add Defender Exclusion.

- Now, restart your computer.

- Finally, open QuickBooks again and try again to get the updates.

7. Run Quick Fix my Program

Quick Fix my Program will automatically close your QuickBooks processes running in the background that may also interrupt payroll updates. This tool will also run quick fixes in your programs.

Note: Get the latest version of QuickBooks Tool Hub.

- Double-click on the QB Tool Hub icon to open.

- Go to Program Problems.

- Hit on Quick Fix my Program.

- Launch QuickBooks Desktop and try to open your company file.

8. Re-install QuickBooks Desktop

Reinstalling QuickBooks Desktop automatically replaces the older program files with the new ones, fixing the associated issues causing QuickBooks error 557 when updating the payroll services. Once the re-installation is done, try updating the payroll services again:

Before getting started

- Download the QuickBooks installer of the same version.

- Note down the product license number. Check the original package or see the purchase confirmation email if you bought it online.

Note: You can also find the same information on your account management portal.

a. Uninstall QuickBooks

- Click on the Windows icon from the Taskbar.

- In the Windows Start menu, type Control Panel.

- Select Control Panel from the search results to open.

- Go to Programs and Features and click on Uninstall a Program.

- Choose your version of QuickBooks Desktop to remove from the list of programs.

- Hit on Uninstall/Change, Remove and then Next.

- Sign out of Windows and log back in as an administrator (or a user with administrator access) if you don’t see this option.

b. Re-install QB Desktop

- Make sure your computer has an active Internet connection.

- Locate the QuickBooks program file; QuickBooks.exe.

- Now, choose

- Express install – Installing QuickBooks Express will replace your previous version and preserve all of your settings. You will need to use custom install to reinstall your previous version.

- Custom and Network Options – Installing the current version at a new location while keeping prior versions installed is made possible by the Custom and Network Options. Your selections from the prior edition are not included in the updated version.

- Hit on Next, then select Install.

- Once done, choose Open QuickBooks.

Conclusion

This guide outlines the causes of QuickBooks Error 557 and provides detailed steps to resolve issues with payroll tax table updates in QuickBooks Desktop. While these expert-recommended solutions are designed to help you troubleshoot effectively, they may not guarantee a resolution in every scenario.

If you continue to experience error 557 or need further assistance, contact QuickBooks ProAdvisors by dialing the toll-free number +1(866)409-5111 for expert guidance.

Frequently Asked Questions

To fix QuickBooks Desktop error 557, first update the software to the latest release and make sure your payroll subscription is active. If the problem persists, temporarily disable antivirus and firewall, or verify your payroll subscription details.

To fix the QuickBooks registration error, run the Quick Fix or Install Diagnostic Tool using the QuickBooks Tool Hub. If this doesn’t work, consider deleting the EntitlementDataStore.ecml file, updating Windows, or reinstalling QuickBooks.

- Let’s see how to register your QuickBooks Desktop manually:

- Launch QuickBooks Desktop.

- Choose Activate QuickBooks Desktop from the Help menu.

- Adhere to the on-screen steps to verify the information.

Payroll tax table update errors in QuickBooks Desktop may appear due to several reasons such as corrupted QuickBooks files or installation, Internet connection problems, incorrect payroll setup, antivirus or firewall interruptions, use of outdated software versions, and other reasons.

No, generally QuickBooks Desktop cannot be used without activation. Because without activation you will not be able to validate your license and enable full functionality and these functionalities are required for all accounting and financial management. So, consider activating your QuickBooks Desktop before starting.