How to Get the QuickBooks Payroll Tax Table Update?

Stay compliant with the latest payroll regulations by updating your QuickBooks Desktop tax tables. Available exclusively for QuickBooks Desktop 2024 and Enterprise Solutions 24.0, these updates deliver accurate federal and provincial tax rates, payroll forms, and EFILE options for active Payroll subscription users. In this article, you’ll discover how to download and install the 2024 version, verify tax table updates, and troubleshoot common issues. Visit our dedicated page regularly for the latest payroll tax table updates for QuickBooks Desktop Canada.

Check the Latest Payroll Tax Table, Download it and More

In this section, we will explore how to check the latest tax table version, review its contents, and troubleshoot any issues encountered during the payroll services update.

Read More- QuickBooks Payroll Update Not Working

The current payroll tax table version

QuickBooks Desktop 2024 payroll tax table version 12134003, released June 24, 2025, is effective July 1 to December 31, 2025.

Check which version you have

Check your version: Go to Employees > My Payroll Service > Tax Table Information. The first three numbers under “You are using tax table version” should show 12134003.

Note: You must use QuickBooks Desktop 2024 or QuickBooks Desktop Enterprise Solutions 24.0 to download this tax table update.

Get the payroll tax table updates

With a QuickBooks Payroll subscription, enable automatic updates to download payroll updates as soon as they’re available.

Alternatively, manually download the latest payroll update directly within QuickBooks at any time.

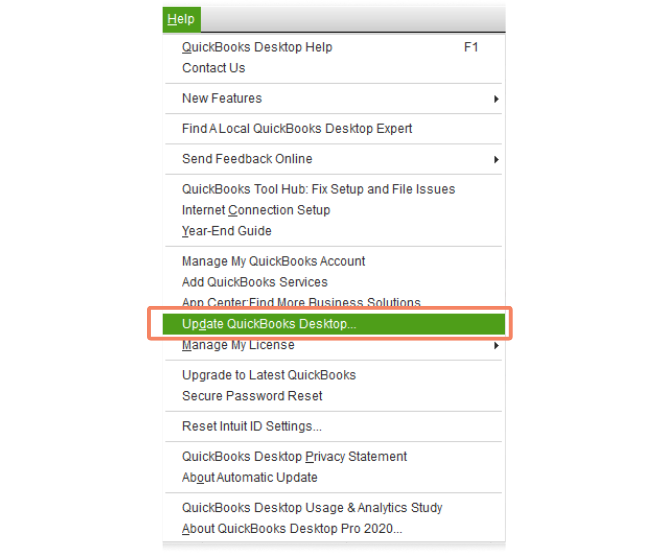

- Navigate to the Help menu.

- Select Update QuickBooks Desktop.

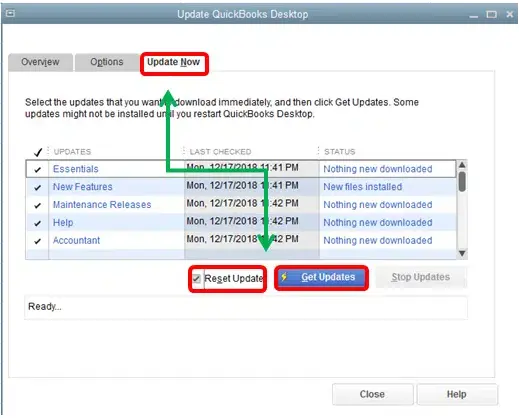

- Go to the Update Now tab.

- Hit on Get Updates.

- Go to File, then select Exit.

- Now, restart your QuickBooks Desktop.

- What’s included in the current payroll tax table update

The January 2025 payroll tax table update has several TD1 adjustments for the July 2025 tax table update.

View the current and historical TD1, CPP, and EI amounts

| Effective Date | 7/1/2025 | 1/1/2025 |

| Tax Table version # | 12134003 | 12034003 |

| TD1 Amounts | ||

| Federal | 16,129.00 | 16,129.00 |

| AB | 22,323.00 | 22,323.00 |

| BC | 12,938.00 | 12,938.00 |

| MB | 15,591.00 | 15,969.00 |

| NB | 13,396.00 | 13,396.00 |

| NL | 11,067.00 | 10,818.00 |

| NS | 11,744.00 | 11,744.00 |

| NT | 17,842.00 | 17,842.00 |

| NU | 19,274.00 | 19,274.00 |

| ON | 12,747.00 | 12,747.00 |

| PE | 15050.00 | 14,250.00 |

| QC | 18,571.00 | 18,571.00 |

| SK | 19,991.00 | 18,991.00 |

| YT | 16,129.00 | 16,129.00 |

| ZZ (employees outside Canada) | 0 | 0 |

| Effective Date | 7/1/2025 | 1/1/2025 |

| Tax Table version # | 12134003 | 12034003 |

| Canada Pension Plan (CPP) – outside Quebec | ||

| Maximum Pensionable Earnings | 71,300.00 | 71,300.00 |

| Basic Exemption | 3,500.00 | 3,500.00 |

| Contribution Rate | 5.95% | 5.95% |

| Maximum Contribution (EE) | 4,034.10 | 4,034.10 |

| Maximum Contribution (ER) | 4,034.10 | 4,034.10 |

| Employment Insurance (EI) – outside Quebec | ||

| Maximum Insurable Earnings | 65,700.00 | 65,700.00 |

| Premium EI Rate (EE) | 1.64% | 1.64% |

| Premium EI Rate (ER) (1.4*EE) | 2.296% | 2.296% |

| Maximum Premium (EE) | 1,077.48 | 1,077.48 |

| Maximum Premium (ER) | 1,508.47 | 1,508.47 |

| Effective Date | 1/1/2025 | 1/1/2025 |

| Tax Table version # | 12134003 | 12034003 |

| Quebec Pension Plan (QPP) | ||

| Maximum Pensionable Earnings | 71,300.00 | 71,300.00 |

| Basic Exemption | 3,500.00 | 3,500.00 |

| Contribution Rate | 6.40% | 6.40% |

| Maximum Contribution (EE) | 4,339.20 | 4,339.20 |

| Maximum Contribution (ER) | 4,339.20 | 4,339.20 |

| Employment Insurance (EI – Quebec only) | ||

| Maximum Insurable Earnings | 65,700.00 | 65,700.00 |

| Premium EI Rate (EE) | 1.31% | 1.31% |

| Premium EI Rate (ER) (1.4*EE) | 1.834% | 1.834% |

| Maximum Premium (EE) | 860.67 | 860.67 |

| Maximum Premium (ER) (1.4*EE) | 1,204.94 | 1,204.94 |

| Quebec Parental Insurance Plan (QPIP) | ||

| Maximum Insurable Earnings | 98,000.00 | 98,000.00 |

| Contribution Rate (EE) | 0.49% | 0.49% |

| Contribution Rate (ER) (1.4*EE) | 0.69% | 0.69% |

| Maximum Contribution (EE) | 484.12 | 484.12 |

| Maximum Contribution (ER) (1.4*EE) | 678.16 | 678.16 |

| Commission des normes du travail (CNT) | ||

| Maximum earnings subject to CNT | 98,000.00 | 98,000.00 |

Troubleshoot payroll update issues

If TD1 amounts aren’t updating after installing the latest tax tables, perform these checks:

Is it on or after the tax table effective date?

If you installed tax table version 12134003 on or after June 24, 2025, the updated TD1 amounts will not apply until the effective date of July 1, 2025.

After July 1, 2025, with the new tax table update installed:

Have you manually adjusted TD1 amounts previously or for new employees?

If TD1 amounts were manually changed for an employee at any point, the new tax table won’t override these adjustments. You must manually update the TD1 amounts moving forward.

Are any employees set up with non-basic TD1 amounts?

QuickBooks Desktop only auto-updates TD1 amounts for employees on basic amounts from prior tax tables. Non-basic amounts require manual updates.

Conclusion

Ensuring your QuickBooks Desktop payroll tax tables are up to date is crucial for accurate payroll processing. By verifying the effective date, checking for manual TD1 adjustments, and confirming employee TD1 settings, you can resolve update issues efficiently. Staying proactive with tax table installations and manual updates for non-basic amounts keeps your payroll compliant and error-free.

Regularly monitor QuickBooks updates to align with the latest tax regulations, saving time and avoiding costly mistakes. For further assistance, connect with QB ProAdvisor on +1(866)409-5111 now!

Frequently Asked Questions

Here’s how to get the latest payroll tax table update:

- Navigate to the Help menu.

- Hit on Update QuickBooks.

- Move to the Update Now tab.

- Now, click on Get Updates.

- Go to File, then select Exit.

- Once done, restart QB Desktop.

To resolve QuickBooks payroll errors, keep the software up to date, ensure the payroll tax table is updated, and verify that you have an active subscription. If the issue persists, consider reinstalling your QuickBooks desktop software.

QuickBooks error code PS038 typically occurs when there are issues updating payroll or when paychecks become stuck in the system during the online sending process. This error can prevent users from downloading payroll updates, hindering their ability to run payroll smoothly.

To manually update your QuickBooks Desktop to the latest release:

- Go to Help at the top menu bar.

- Click Update QuickBooks Desktop in the menu.

- Move to the Update Now tab and choose the updates you want to get.

- Now, click Get Updates.

- Once done, reopen QuickBooks and click Yes to install the updates.

QuickBooks Desktop error 30159 is a payroll-related issue that typically occurs when updating the payroll tax table in QuickBooks encounters an error. It may also indicate that the software is having trouble validating your payroll subscription.